Irs Meals And Entertainment Deduction 2024 – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. . This tax season, the IRS said it’s adding staff and technology to “reverse the historic low audit rates” on high-income taxpayers. Filing season can already be a stressful time for many people, with .

Irs Meals And Entertainment Deduction 2024

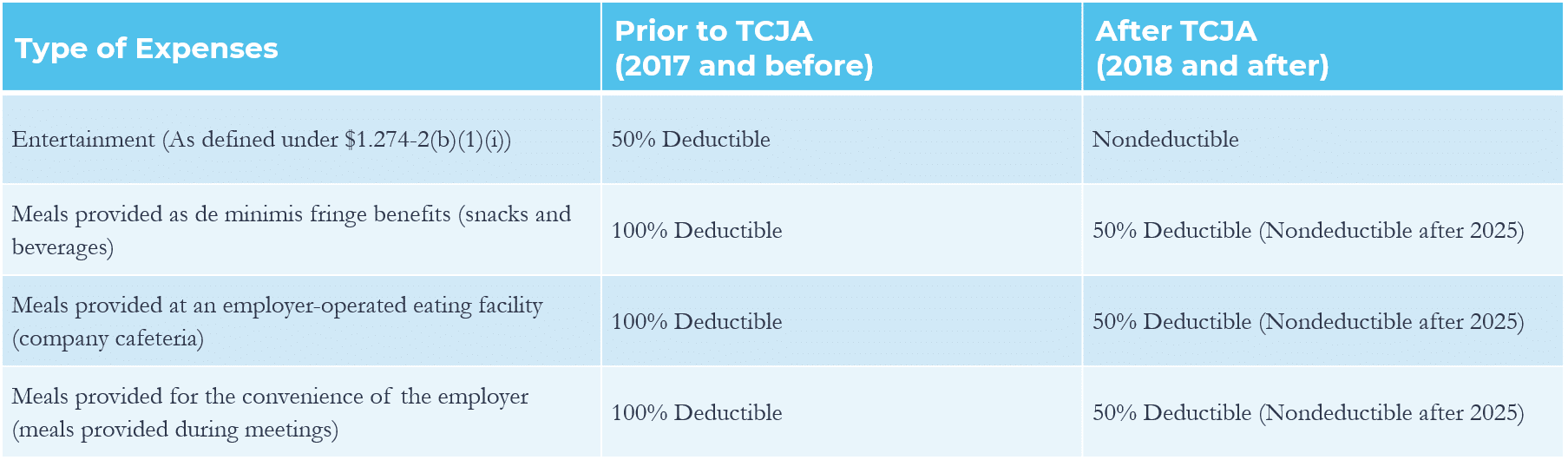

Source : ledgergurus.comUnderstanding Business Meal and Entertainment Deduction Rules

Source : www.seldenfox.comExpanded meals and entertainment expense rules allow for increased

Source : www.plantemoran.comNavigating the New Meals and Entertainment Deductions under TCJA

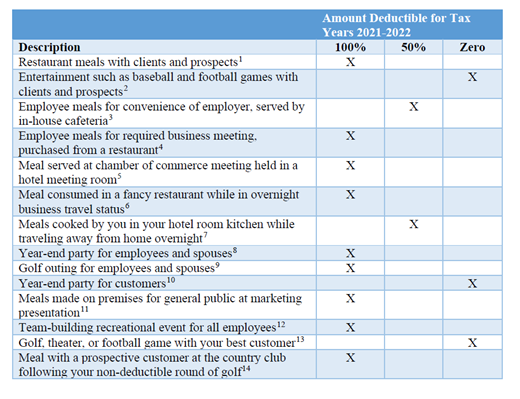

Source : www.grfcpa.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comDeducting Meals and Entertainment in 2021 2022 Lifetime Paradigm

Source : lifetimeparadigm.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coPublication 463 (2023), Travel, Gift, and Car Expenses | Internal

Source : www.irs.govDeducting Meals as a Business Expense

Source : www.thebalancemoney.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comIrs Meals And Entertainment Deduction 2024 Meal and Entertainment Deductions for 2023 2024: The Internal Revenue Service will receive and process tax returns for fiscal year 2023 until April 15, 2024.Taxpayers can make use of some tools such as tax deductions and credits that could reduce . The Internal Revenue Service recently released a guide for filing an accurate return with everything to know before filing, and what has changed in tax law in 2024. Here is everything to know before .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)